Direct Mortgage Loans

Blake Hyatt

About Me

Blake Hyatt, Branch Manager of The Hyatt Team, brings extensive experience working in the mortgage industry and is recognized as one of the youngest top-producing branch managers. Specifically, he has ranked in the top 1% in Loan Origination and has helped thousands of people achieve their dream of owning a home.

Moreover, Blake values treating his clients like family and places great importance on building long-term relationships founded on trust and satisfaction. He prioritizes personalized communication and provides his clients with mortgage solutions that are customized to meet their current and future needs.

Primary Residential Mortgage, Inc.

Kaoru Forbess

About Me

Kaoru Forbess is a University of Maryland, College Park graduate who was a member of the 2008 National Championship winning Men’s soccer team. Upon graduation, Kaoru wrapped up his soccer career as a Major Arena Soccer League champion with the Baltimore Blast.

Kaoru began his mortgage career in 2015 and built his business through customer service and client referrals. He is licensed in Maryland, Pennsylvania, D.C., Virginia, and can offer a variety of products that will fit the customer’s needs. Surrounded by great support staff and a fun atmosphere at Primary Residential Mortgage, Kaoru will make sure that your home buying process is smooth and enjoyable.

Guild Mortgage

Mike Homberg

About Me

Let’s find the right home loan for you. We have loan options to fit every situation, from down payment assistance programs for first-time homebuyers to government-sponsored programs for military families and rural residents or jumbo loans in high-cost markets. I am authorized to do business in the states of District of Columbia, Delaware, Maryland, Pennsylvania and Virginia.

Let’s find you the right mortgage loan

Start The Process

We’ll help you find a local loan originator to get you competitive rates and the programs that best fit your individual needs. Fill out this form and we’ll connect you with a lender today!

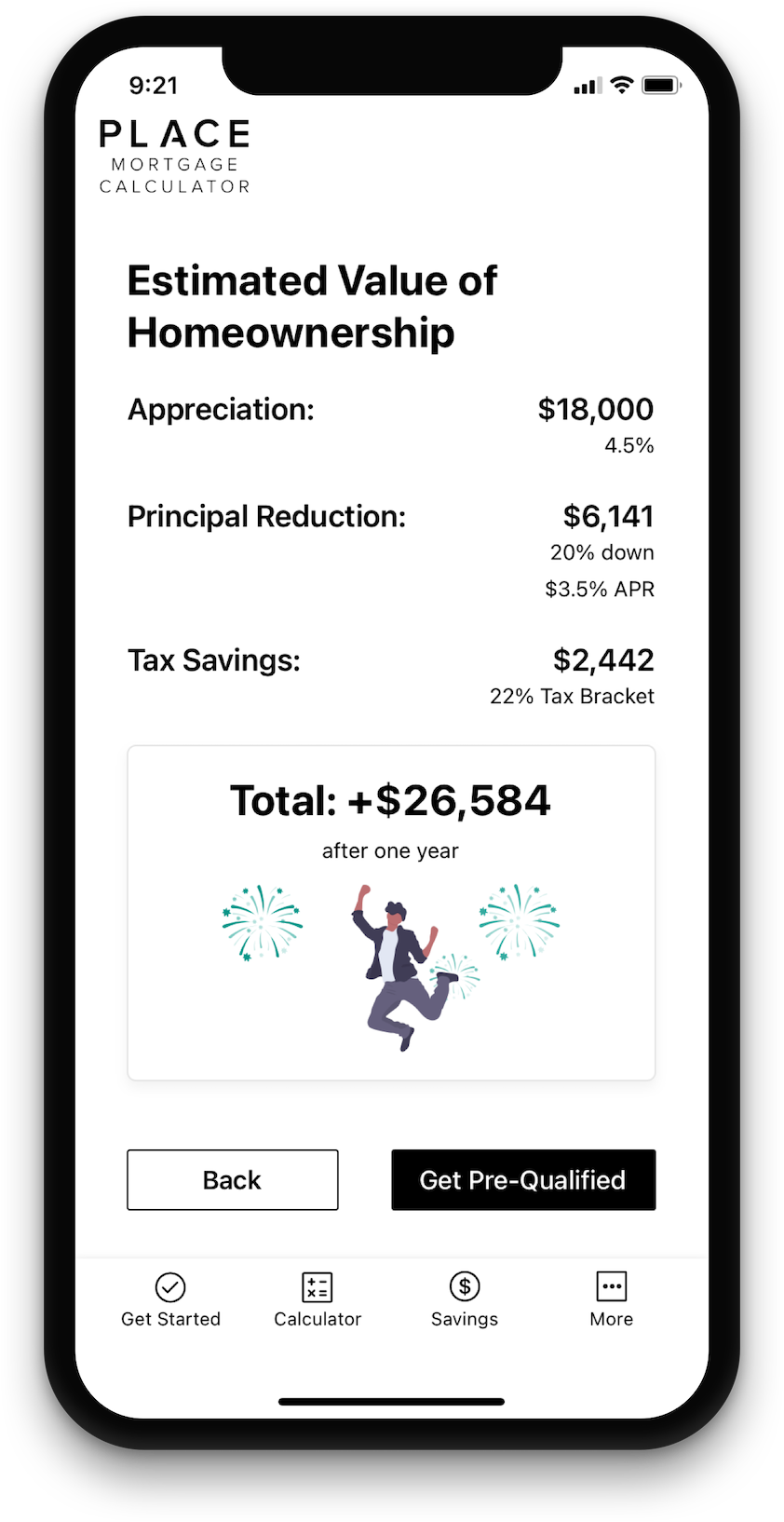

ESTIMATE YOUR MONTHLY PAYMENT

Estimate your mortgage payment, including the principal and interest, taxes, insurance, HOA, and Private Mortgage Insurance.

Price

Annual Tax

Loan Term (Years)

Down Payment %

Interest Rate %

Monthly HOA

Monthly Insurance

$3,198.20

Estimated Monthly Payment

Principal

$2,398.20

(75.0%)Taxes

$500.00

(15.6%)HOA

$100.00

(3.1%)Insurance

$200.00

(6.3%)Get Pre-Approved

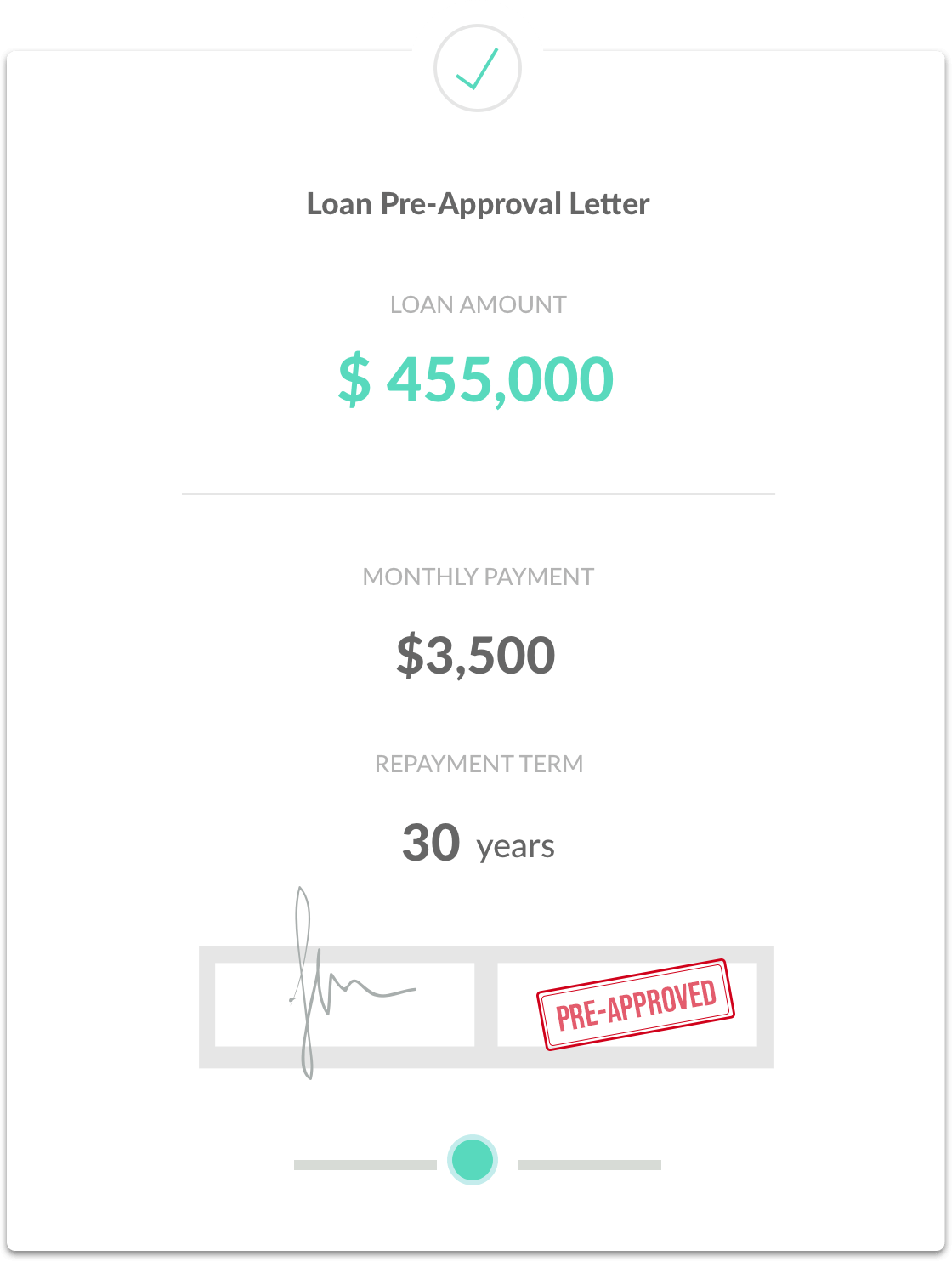

Before you start looking for a home to buy, it’s a good idea to meet with your loan originator to get pre-approved for a loan amount. At this stage, the lender gathers information about income, assets, and debts of the borrower (you) to determine how much house you may be able to afford. This includes a credit report, W-2 forms, pay stubs, Federal Tax Returns, and recent bank statements. There are a variety of different loan programs, so make sure to get pre-qualification for the specific programs that best suit your needs.

Application & Processing

What happens when a loan goes "live"

When you find property you’re ready to buy, your lender will help you complete a full mortgage loan application, and talk you through the various fees and down payment options. The application is submitted to processing, where the documents are reviewed and appraisals and title examination are ordered. Then the loan is sent to an underwriter, who reviews and approves the entire loan if it meets compliance.

Closing

Signing and Finalizing the deal

Don’t be surprised if you’re asked for additional documentation or clarification throughout the process. Once your loan is approved, don’t forget to set up homeowners insurance. Your documents will be sent to the title company, where you’ll sign for the new home and pay any remaining costs. Then the loan is recorded and you get the keys. Congratulations, happy homeowner!

.png)